Bank Of Canada Bond Tapering

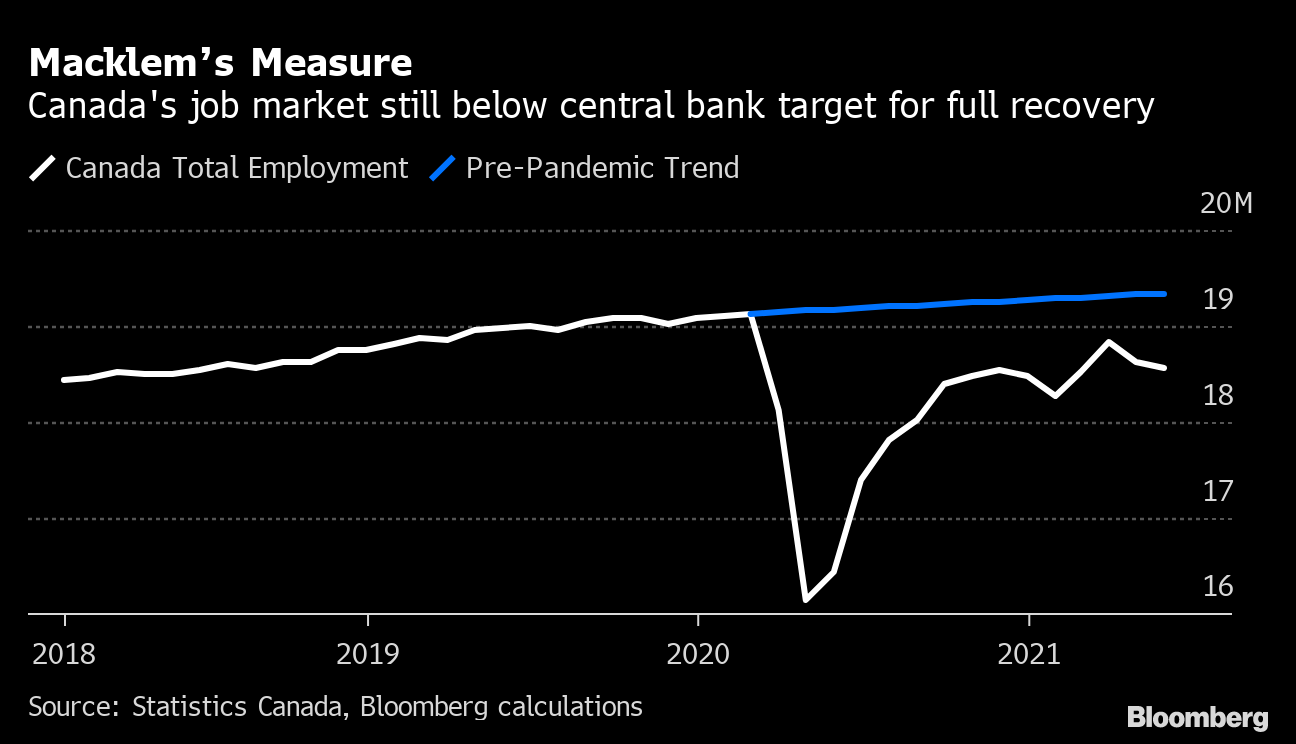

Jobs Data Likely Seals The Case For Bank Of Canada Taper Next Week. Bank of Canada BoC deputy governor Gravelle announced the end of many market support programs on Tuesday.

Pin On Semiotics December 2020

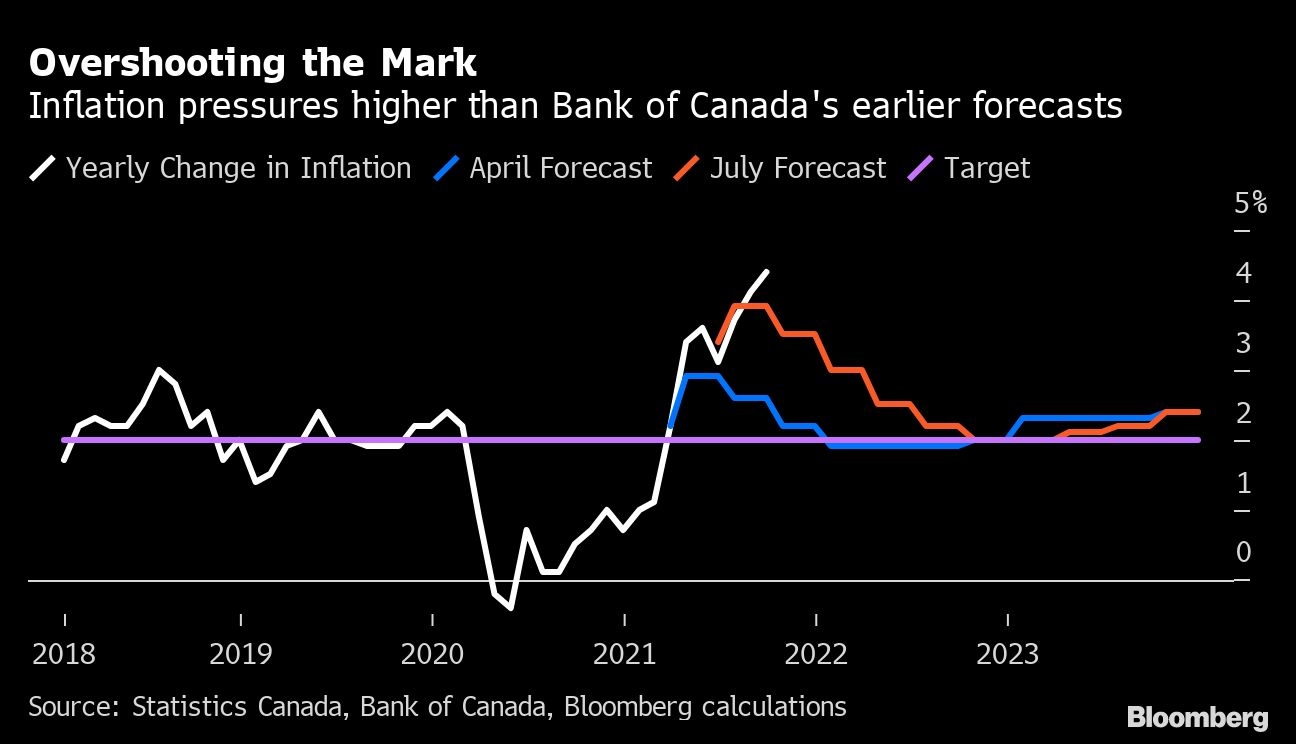

The Open BoC and Fed will react if there is ongoing inflation in 2023.

Bank of canada bond tapering. Bank of Canada sees 2022 rate hike tapers bond-buying program. In the US investors arent pricing in any rate hike by the Federal Reserve over the next year and only two over the next two years. Tapering bond purchases by 3 billion a week.

The Bank of Canada is telling us higher variable mortgage rates are probably coming sooner than expected. Bond tapering The Bank of Canada cut its weekly net purchases of Canadian government bonds to a target of C3 billion 24 billion from C4 billion. Bank Of Canada Now Owns 40 Of Government Of Canada Bonds Fed A Saint In Comparison Taper On The Table Wolf Street.

The Bank of Canada also denied initially it was tapering The Bank of Canada which now has a super-mega housing bubble on its hands blazed the trail last October when it announced that it would taper its purchases of Government of Canada bonds from C5 billion a week to C4 billion a week and that it would stop buying MBS altogether. Wednesday according to a survey of 17 economists. At the time it also ended buying mortgage-backed securities.

The Ottawa-based central bank is unanimously forecast to cut its weekly purchases of Canadian government bonds by one-third to 2 billion US16 billion per week when it announces its policy decision at 10 am. The Canadian economy is improving faster than expected meaning supports can start fading. Another round of tapering warranted by a stronger outlook As widely expected the Bank of Canada reduced its weekly bond purchases by another C1bn today from C3bn to C2bn.

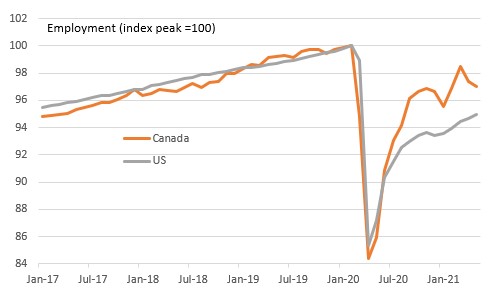

Canada is on a solid economic recovery path. An improved economic outlook and growing confidence among central bankers have created the conditions in which the Bank of Canada is now comfortable paring back the pace of bond purchases by 3 billion. The Bank of Canada.

After all the signals coming from the jobs market had been clear. Bank Of Canada Policy Decision Tapering Bond Purchases By 3 Billion A Week The Real Economy Blog. David Dodge senior advisor at Bennett Jones and former Bank of Canada governor joins BNN Bloomberg with his latest economic outlook.

Advertisment The Bank of Canada has released its first guidance on how it. The Bank of Canada has bought a net C320 billion in Canadian government bonds since the start of the pandemic and said it wants to hit a net-zero purchase level before it starts to consider raising rates. We apologize but this video has failed to load.

A bond tapering story. Bank of Canada Announces End To Many Market Supports Suggests QE Taper. Investors brace for another Bank of Canada bond taper.

The Bank of Canada BoC will set its policy on Wednesday at 1400 GMT two days after Trudeaus government tables its first budget in. The Bank of Canada BoC will set its policy on Wednesday at 1400 GMT two days after Trudeaus government tables its first budget in two years. The Bank of Canada has decided to reduce the pace of its bond purchases.

The Bank of Canada which already holds over 40 of all outstanding Government of Canada GoC bonds compared to the Fed which holds less than 18 of all outstanding US Treasury securities announced today that it would reduce by one-quarter the amount of GoC bonds it adds to its pile from C4 billion per week currently to C3 billion per week beginning April 26. Bank Of Canada To Raise Interest Rates Before Tapering Bond Purchases. The first taper announcement came in October last year when the Bank of Canada said it would reduce its purchases of Government of Canada GoC bonds from C5 billion a week to C4 billion a week.

Bank of Canada policy decision. The economy has improved meaning the. Given earlier warnings the central bank is expected to stick to its plan and scale down its bond program although the.

The central bank has bought 336 billion in Canadian government bonds under its asset purchase program also known as quantitative easing. The Bank of Canada also denied initially it was tapering The Bank of Canada which now has a super-mega housing bubble on its hands blazed the trail last October when it announced that it would taper its purchases of Government of Canada bonds from C5 billion a week to C4 billion a week and that it would stop buying MBS altogether. What That Means for US.

The Bank of Canada BoC becomes the first central bank to signal an exit from stimulus and have begun tapering. Although the Bank of Canada rate decision and press conference does not get as much attention as the Federal Reserve yesterdays announcement was big and took the markets and many including me by surprise. In July the BOC tapered its weekly QE pace to 2 billion from 3 billion in a continuation of an every-second-meeting slide in purchases.

Canada Is Tapering Bond Purchases. The Bank of Canada also denied initially it was tapering The Bank of Canada which now has a super-mega housing bubble on its hands blazed the trail last October when it announced that it would taper its purchases of Government of Canada bonds from C5 billion a week to C4 billion a week and that it would stop buying MBS altogether. The Taper Next Door Bank Of Canada Cuts Bond Purchases By 25.

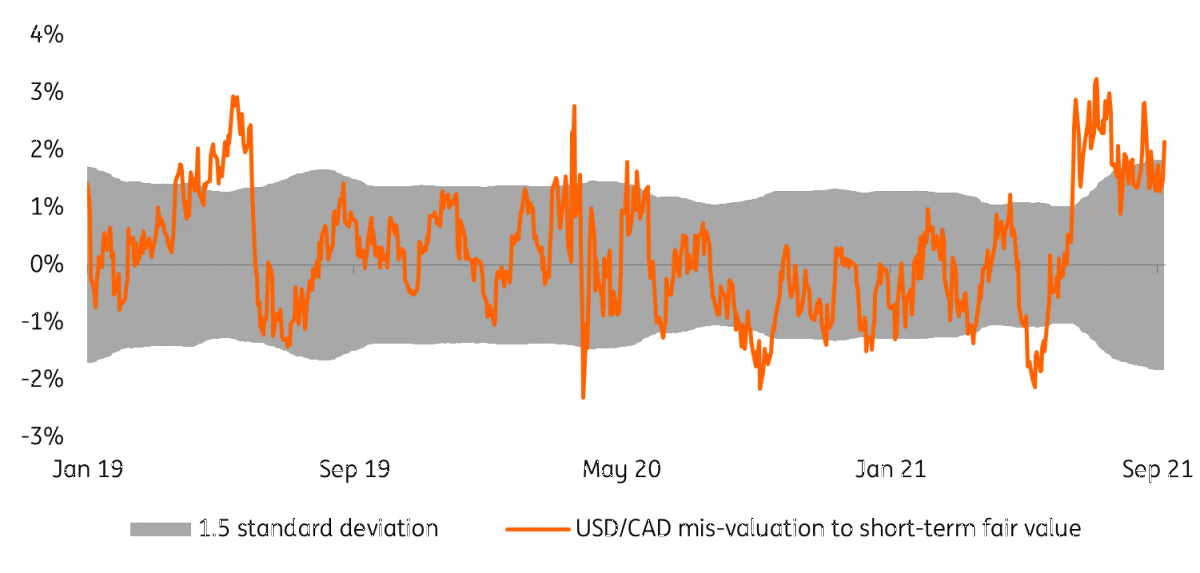

That matters for markets because it. It started buying 5 billion a week initially but has since tapered those purchases three times to bring it to the current level of 2 billion a week. Former BoC governor David Dodge.

The Bank of Canada is expected to continue tapering its asset purchases and maintain its current rate posture when it concludes it meeting on Wednesday at 1000. This is the first meeting since then and expectations. The Bank of Canada cut its weekly net purchases of Canadian government bonds to a target of C3 billion 24 billion from C4 billion saying the adjustment reflected the progress made in the economic recovery.

This adjustment to the amount of incremental stimulus being added each week reflects the progress made in the economic recovery The overnight rate stays at 025 per cent. Bank of Canada policy meeting. Shelly Hagan and Erik Hertzberg Bloomberg News.

Effective the week of April 26 weekly net purchases of Government of Canada bonds will be adjusted to a target of 3 billion said the Bank of Canada in a release.

Bank Of Canada Holds Steady Ahead Of Possible July Taper Bloomberg

Canada Business Sentiment Rebounded Before Second Wave Lockdowns In 2021 Rebounding Canada Vancouver Restaurants

Australia Home Prices Fall With Risks Skewed To Downside House Prices Australian Homes Distressed Property

U K Retail Sales Lose Steam As Firms Shoppers Fret Over Prices In 2021 Retail Sales Retail Picture

Canada No Longer Needs Strong Stimulus Central Bank Says Raster To Vector Bank Jpg To Vector

Bank Of Canada Sits Tight But Expect More Tapering Article Ing Think

Bank Of Canada Holds Steady Ahead Of Possible July Taper Bloomberg

Qe Party Over Bank Of Japan Stealth Tapers Further Bank Of Japan Japan Bank

Bank Of Canada Continues Taper Central Banking

Pin On Semiotics September 2021

Bank Of Canada Sits Tight But Expect More Tapering Article Ing Think

Bank Of Canada Sits Tight But Expect More Tapering Article Ing Think

Global Growth And Optimism Slide To Two Year Lows But Prices Rise At Record Rate Optimism Global Growth

Baker Hughes Sees Slower U S Shale Drilling For Rest Of 2021 In 2021 Baker Hughes Shale Drill

Once Crisis Tools Have Served Their Purpose Central Banks Should Scale Them Back By Wolf Richter For Wolf Street The Bank In 2021 Balance Sheet Bank Corporate Bonds