Bank Of Canada Cbdc And Monetary Policy

I Contingent transfers NOT allowed. The paper then sets out a benchmark central bank digital currency CBDC with features that are similar to cash.

Retail Central Bank Digital Currency Design Considerations Rationales And Implications Bulletin September Quarter 2020 Rba

Central bank digital currency cash monetary policy.

Bank of canada cbdc and monetary policy. Une monnaie électronique de banque centrale MEBC présente des avantages potentiels dont la possibilité quelle puisse. The starting point for thinking about a CBDC is the Bank of Canadas mandate to promote the economic and financial well-being of Canadians. Advantages of Central Bank Digital Currency.

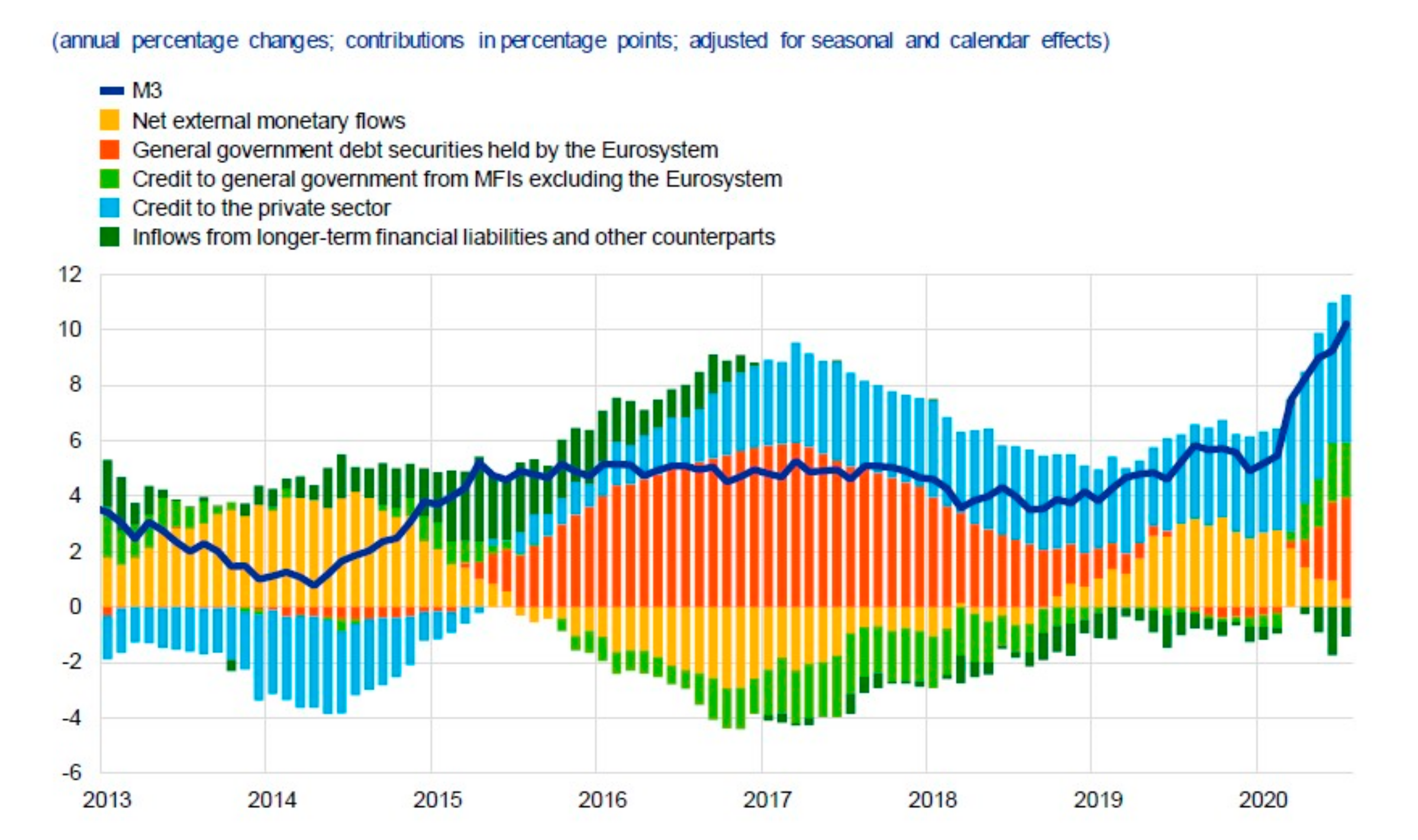

The Bank is forecasting growth of about 6 percent this year slowing to about 4 ½ percent in 2022 and 3 ¼ percent in 2023. This flexibility can help central banks implement monetary policy more effectively and achieve higher welfare. The policy community is being aided by the wider academic communityfor instance Bjerg 2018 Bordo and Levin 2019 We would.

We consider how a central bank digital currency CBDC could transform all aspects of the monetary system and facilitate the systematic and transparent conduct of monetary policy. However central banks also need to continue to make central bank money. Monetary policy JEL codes.

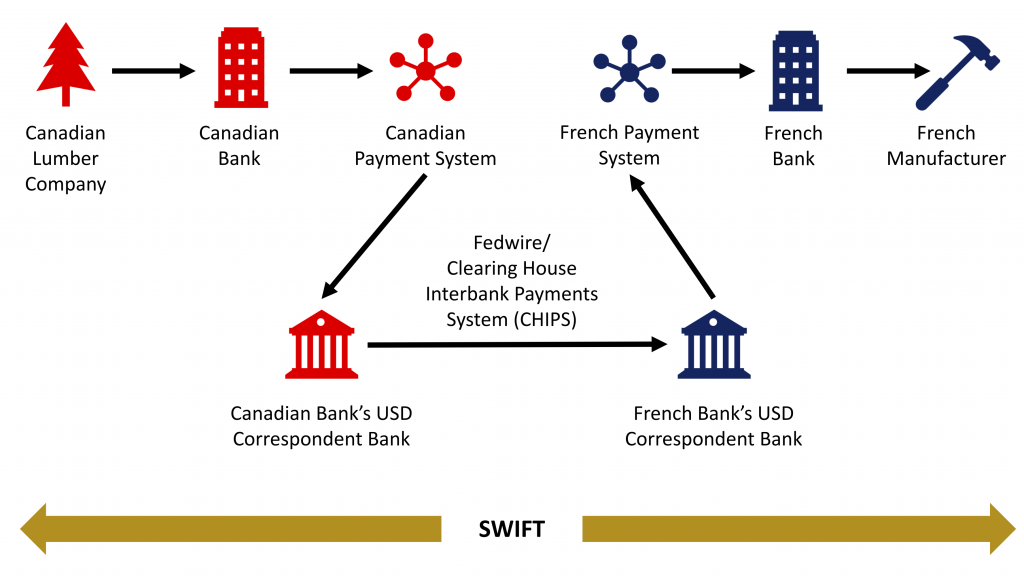

This concern is highlighted in the report on CBDC from the Bank for International Settlement which argues that fi. The central bank can allocate transfers to agents based on their CBDC balances but cannot do so based on their cash balances because the central bank cannot see agents cash balances. A CDBC could offer a new digital payment rail and an asset for real-time final settlement between individualsa similar niche that physical cash has today3 As noted by He 2018 modern monetary policy based on the collective action of monetary policy committees and supported by central bank independence is likely to offer the best hope for maintaining a stable unit of account.

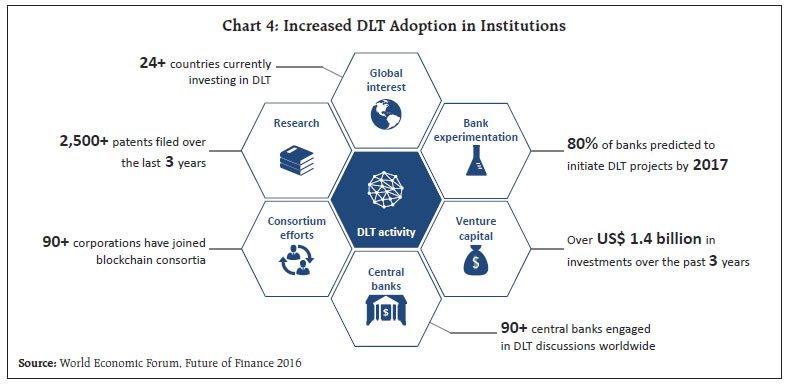

The second is the role of a CBDC in responding to the surge of alternative digital currencies which could threaten Canadas monetary sovereignty. Including the Bank of Canada 2017 the European Central Bank Lagarde 2020 the Peoples Bank of China 2020 the Sveriges Riksbank 2021 and the Bank of England 2020. An anonymous token-based central bank digital currency CBDC would pose certain security risks to users.

We discuss the effects or pass-through of two monetary policy tools. We find that when it is in effect the interest on CBDC fully dictates the deposit rate and eliminates the pass-through from the interest on reserves to the deposit rate. Bank of Canada davobankofcanada.

These risks arise from how balances are aggregated from their transactional use and from the competition between suppliers of aggregation solutions the report reads. How the interest on CBDC. Eg cost of losing anonymity I Cash.

Overall the likelihood of the widespread adoption of an alternative digital currency not denominated in Canadian dollars remains small. The Banks mandate is fulfilled through its core functions. It will be a decentralized currency-Unlike the other cryptocurrencies like Bitcoin which are operated via Blockchain network the CBDC will be a state-owned and state-issued and state-controlled digital assetAs it is state-owned and controlled it will be far more secure than normal cryptocurrencies.

Specifically we examine how in the presence of each other these two policy tools affect the rates and quantities of deposits and loans. Books and Monographs. Conducting monetary policy to deliver low stable and predictable inflation.

I do however remain conscious of the negative points raised by research done by the Bank of Canada and agree any security breaches of its digital currency could potentially negatively affect the central banks reputation when it carries out its other functions such as conducting monetary policy and financial stability policy FungB Halaburda H 2016 Bank of Canada Central Bank Digital. Cash and a CBDC are different along two dimensions in this paper. 3 Impact on monetary policy strategy and implementa-tion The sole introduction of CBDC would have an impact on the overall conditions in which monetary policy is carried out even if over longer run central banks should ensure that CBDC like cash now is a neutral autonomous factor for monetary policy.

However the Bank of Canada. The interest on reserves and the interest on CBDC. CBDC and Monetary Sovereignty Staff Analytical Notes 2020-5 Bank of Canada.

In particular we find that CBDC can serve as a practically costless medium of exchange secure store of value and stable unit of account. According to the Canadian central bank report the risks of CBDCs basically revolve around accumulated balances. A CBDC can allow for different interest rates on different balances or on different types of accountssuch as different rates for households than for businesses or for different sectors of the economy.

Only lump sum subsidies I ZERO cost Mohammad Davoodalhosseini CBDC Monetary Policy 321. Sovereignty of monetary policy transmission when discussing the objectives of a retail CBDC in Canada. Counter-cyclical Economic Policy OECD Economics Department Working Papers 760 OECD Publishing.

We find that when it is in effect the interest on CBDC fully dictates the deposit rate and eliminates the pass-through from the interest on reserves to the deposit rate. Monetary Policy Report July 2021. We discuss the effects or pass-through of two monetary policy tools.

The implications of such a digital currency are explored focusing on central bank seigniorage monetary policy the banking system and financial stability and payments. I study optimal monetary policy in the presence of cash and CBDC. For example if the cost of using a CBDC relative to cash is around 025 of the transaction value introducing a CBDC can lead to an increase of 012-021 consumption for the United States and 004-007 for Canada.

First the ability of the central bank to implement monetary policy is different across these means of payment. One concern is that CBDC might crowd out bank deposits increase banksfunding costs and reduce lending and investment ie bank disintermediation. Finally a CBDC that differs from the benchmark digital currency in a significant way is considered.

Douglas Sutherland Peter Hoeller Balázs Égert Oliver Röhn 2010. This paper outlines the Bank of Canadas motivations behind retail CBDC issuance the attributes needed for successful retail CBDC implementation in Canada and investigates token versus account-based retail CBDC design considerations. The welfare gains of introducing CBDC are estimated as up to 064 for Canada.

Specifically we examine how in the presence of each other these two policy tools affect the rates and quantities of deposits and loans. Summary of Government of Canada Direct Securities and Loans. How the interest on CBDC.

I Allows transfers contingent on balances I Fixed cost of carrying for agents. Monetary Policy with a Central Bank Digital Currency. Therefore the only policy that the central bank.

The interest on reserves and the interest on CBDC. As the economy reopens after the third wave of COVID-19 growth should rebound strongly. E42 E50 Résumé Nombreuses sont les banques centrales qui se demandent si elles devraient émettre une monnaie électronique.

To achieve these criteria CBDC would be account-based and interest-bearing and the monetary policy. Antonio Diez de los Rios Yu Zhu 2020. Central Bank Digital Currency CBDC into their economies1 Issuing CBDC would have implications for monetary policy and banking.

Design Choices Of Central Bank Digital Currencies Will Transform Digital Payments And Geopolitics Atlantic Council

Economies Free Full Text Reasons Fostering Or Discouraging The Implementation Of Central Bank Backed Digital Currency A Review Html

Digital Disruption The Inevitable Rise Of Cbdc Suerf Policy Notes Suerf The European Money And Finance Forum

Overview Of Central Bank Digital Currency State Of Play Suerf Policy Notes Suerf The European Money And Finance Forum

A Survey Of Research On Retail Central Bank Digital Currency In Imf Working Papers Volume 2020 Issue 104 2020

Overview Of Central Bank Digital Currency State Of Play Suerf Policy Notes Suerf The European Money And Finance Forum

Reserve Bank Of India Rbi Bulletin

Sustainability Free Full Text The Future Of Money And The Central Bank Digital Currency Dilemma Html

Legal Aspects Of Central Bank Digital Currency Central Bank And Monetary Law Considerations In Imf Working Papers Volume 2020 Issue 254 2020

Pdf Central Bank Digital Currency Motivations And Implications

Retail Central Bank Digital Currency Design Considerations Rationales And Implications Bulletin September Quarter 2020 Rba

A Survey Of Research On Retail Central Bank Digital Currency In Imf Working Papers Volume 2020 Issue 104 2020

Cbdc Navigator 219 Reports On Sentral Bank Digital Currency 2021

Legal Aspects Of Central Bank Digital Currency Central Bank And Monetary Law Considerations In Imf Working Papers Volume 2020 Issue 254 2020